Planning for the future is one of the most important steps you can take to protect your loved ones and ensure your assets are distributed according to your wishes. Whether you’re drafting a will, setting up a trust, or navigating complex estate laws, finding the best Lawyers Near Me for wills and estate planning is crucial. This comprehensive guide will help you understand the key aspects of estate planning, how to choose the right attorney, and why professional legal assistance is essential for safeguarding your legacy.

Why Estate Planning is Essential for Everyone

Estate planning is not just for the wealthy—it’s a vital process for anyone who wants to ensure their assets, healthcare preferences, and family’s future are protected. Without a proper estate plan, state laws (intestacy laws) will determine how your property is distributed, which may not align with your intentions. Key reasons to prioritize estate planning include:

- Avoiding Probate Delays – A well-structured will or trust can help your heirs bypass lengthy and costly probate proceedings.

- Minimizing Estate Taxes – Strategic planning can reduce tax burdens on your beneficiaries.

- Protecting Minor Children – Appointing guardians ensures your children are cared for by trusted individuals.

- Healthcare Directives – Documents like a living will or healthcare proxy specify your medical wishes if you become incapacitated.

- Business Succession – If you own a business, estate planning ensures a smooth transition.

Key Legal Documents in Wills and Estate Planning

A thorough estate plan involves multiple legal documents, each serving a unique purpose. The most essential include:

1. Last Will and Testament

A will outlines how your assets should be distributed, names an executor to manage your estate, and can designate guardians for minor children. Without a will, the court decides these matters.

2. Revocable Living Trust

A trust allows assets to pass directly to beneficiaries without probate. It offers privacy, flexibility, and can be modified during your lifetime.

3. Durable Power of Attorney

This document appoints someone to handle financial decisions if you become unable to do so.

4. Healthcare Power of Attorney & Living Will

These specify your medical treatment preferences and designate someone to make healthcare decisions on your behalf.

5. Beneficiary Designations

Certain assets (life insurance, retirement accounts) pass directly to named beneficiaries, bypassing the will.

How to Find the Best Estate Planning Lawyers Near Me

Choosing the right attorney is critical for creating a legally sound estate plan. Here’s how to find top-rated Lawyers Near Me in your area:

1. Look for Specialized Experience

Seek attorneys who focus exclusively on estate planning, wills, and trusts rather than general practitioners.

2. Check Credentials & Reviews

Verify their standing with state bar associations and read client testimonials on platforms like Avvo, Google, and Martindale-Hubbell.

3. Compare Fees & Services

Some Lawyers Near Me charge flat fees for estate plans, while others bill hourly. Ensure transparency in pricing before hiring.

4. Schedule Consultations

Meet with multiple attorneys to assess their communication style, expertise, and willingness to explain complex legal terms.

5. Evaluate Their Approach

A good estate planning Lawyers Near Me should tailor solutions to your unique needs, not offer a one-size-fits-all approach.

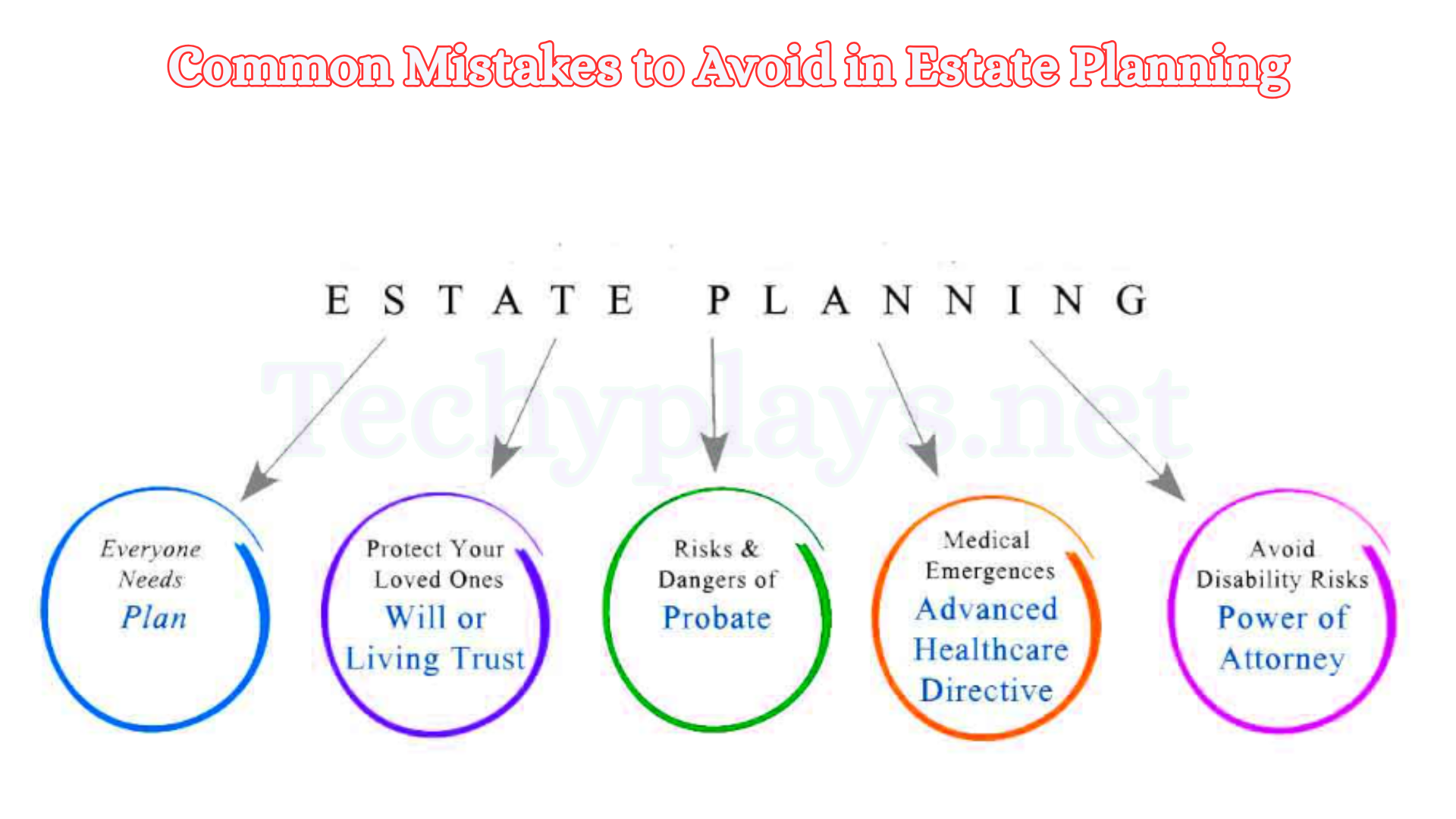

Common Mistakes to Avoid in Estate Planning

Even with the best intentions, errors in estate planning can lead to disputes or unintended consequences. Avoid these pitfalls:

- Not Updating Documents – Life changes (marriages, divorces, births, deaths) require updates to your will or trust.

- Overlooking Digital Assets – Include online accounts, cryptocurrencies, and social media in your estate plan.

- Choosing the Wrong Executor – Select someone trustworthy and capable of handling legal and financial responsibilities.

- DIY Wills & Online Forms – Generic templates may not comply with state laws, leading to invalid documents.

The Role of a Probate Lawyer in Estate Administration

If a loved one passes away without a will, probate Lawyers Near Me help navigate court-supervised asset distribution. They assist with:

- Filing necessary court documents

- Resolving creditor claims

- Handling disputes among heirs

- Ensuring legal compliance

Estate Planning for High-Net-Worth Individuals

Wealthier individuals often require advanced strategies, such as:

- Irrevocable Trusts – For asset protection and tax benefits

- Charitable Trusts – To support causes while reducing estate taxes

- Family Limited Partnerships (FLPs) – For business succession and wealth transfer

Introduction: The Importance of Professional Estate Planning

No one likes to think about their own mortality, but failing to plan for the future can leave your loved ones in financial and legal turmoil. Whether you have a modest estate or significant assets, having a well-structured will and estate plan ensures that your wishes are honored, your family is protected, and your hard-earned wealth is distributed according to your intentions.

This comprehensive guide will walk you through everything you need to know about finding the best wills and estate planning Lawyers Near Me. From understanding key legal documents to avoiding common pitfalls, we’ll provide expert insights to help you make informed decisions.

See Also S&P Global Marketplace

Section 1: Understanding Wills and Estate Planning

What Is Estate Planning?

Estate planning is the process of arranging for the management and distribution of your assets after your death or in the event of incapacitation. It involves legal documents such as wills, trusts, powers of attorney, and healthcare directives.

Why You Need an Estate Plan (Even If You’re Not Wealthy)

Many people mistakenly believe estate planning is only for the ultra-wealthy. However, without a proper plan:

- The state decides who inherits your assets (intestate succession).

- Your family may face lengthy and costly probate court proceedings.

- Minor children could be assigned guardians without your input.

- Disputes among heirs may arise, leading to family conflicts.

Key Differences Between a Will and a Trust

| Feature | Will | Trust |

|---|---|---|

| Probate | Goes through probate court | Avoids probate |

| Privacy | Public record | Private |

| Flexibility | Can be changed anytime | Revocable or irrevocable |

| Cost | Lower upfront cost | Higher initial setup cost |

Choosing between a will and a trust depends on your assets, family situation, and goals. An experienced estate planning attorney can help determine the best option.

Section 2: How to Find the Best Estate Planning Lawyers Near You

1. Look for Specialization in Estate Law

Not all Lawyers Near Me are created equal. Seek attorneys who focus exclusively on:

- Wills & trusts

- Probate & estate administration

- Elder law & Medicaid planning

- Tax-efficient wealth transfer

Avoid general practitioners who lack deep expertise in estate law.

2. Check Credentials & Reputation

- State Bar Association – Verify their license and disciplinary history.

- Client Reviews – Check Google, Avvo, and Martindale-Hubbell for testimonials.

- Peer Ratings – Look for “Super Lawyers” or “Best Lawyers in America” recognition.

3. Compare Fee Structures

Estate planning attorneys may charge:

- Flat fees (common for simple wills & trusts)

- Hourly rates (for complex cases)

- Retainer agreements (ongoing legal counsel)

Always request a clear fee breakdown before hiring.

4. Schedule a Consultation

A good lawyer should:

- Explain legal concepts in plain language.

- Offer personalized solutions (not a one-size-fits-all approach).

- Be responsive and transparent about costs.

5. Ask the Right Questions

During your consultation, ask:

- “How many estate plans have you drafted?”

- “Do you handle probate cases if disputes arise?”

- “Will you help update my documents as laws change?”

Section 3: Essential Estate Planning Documents

1. Last Will & Testament

- Names beneficiaries for assets not in a trust.

- Appoints an executor to manage your estate.

- Designates guardians for minor children.

2. Revocable Living Trust

- Avoids probate.

- Allows for incapacity planning.

- Can be modified during your lifetime.

3. Durable Power of Attorney (Financial)

- Authorizes someone to manage finances if you’re unable.

4. Healthcare Power of Attorney & Living Will

- Specifies medical treatment preferences.

- Names a healthcare proxy for decision-making.

5. Letter of Intent (Optional but Helpful)

- Provides informal guidance on funeral wishes, digital assets, and personal messages.

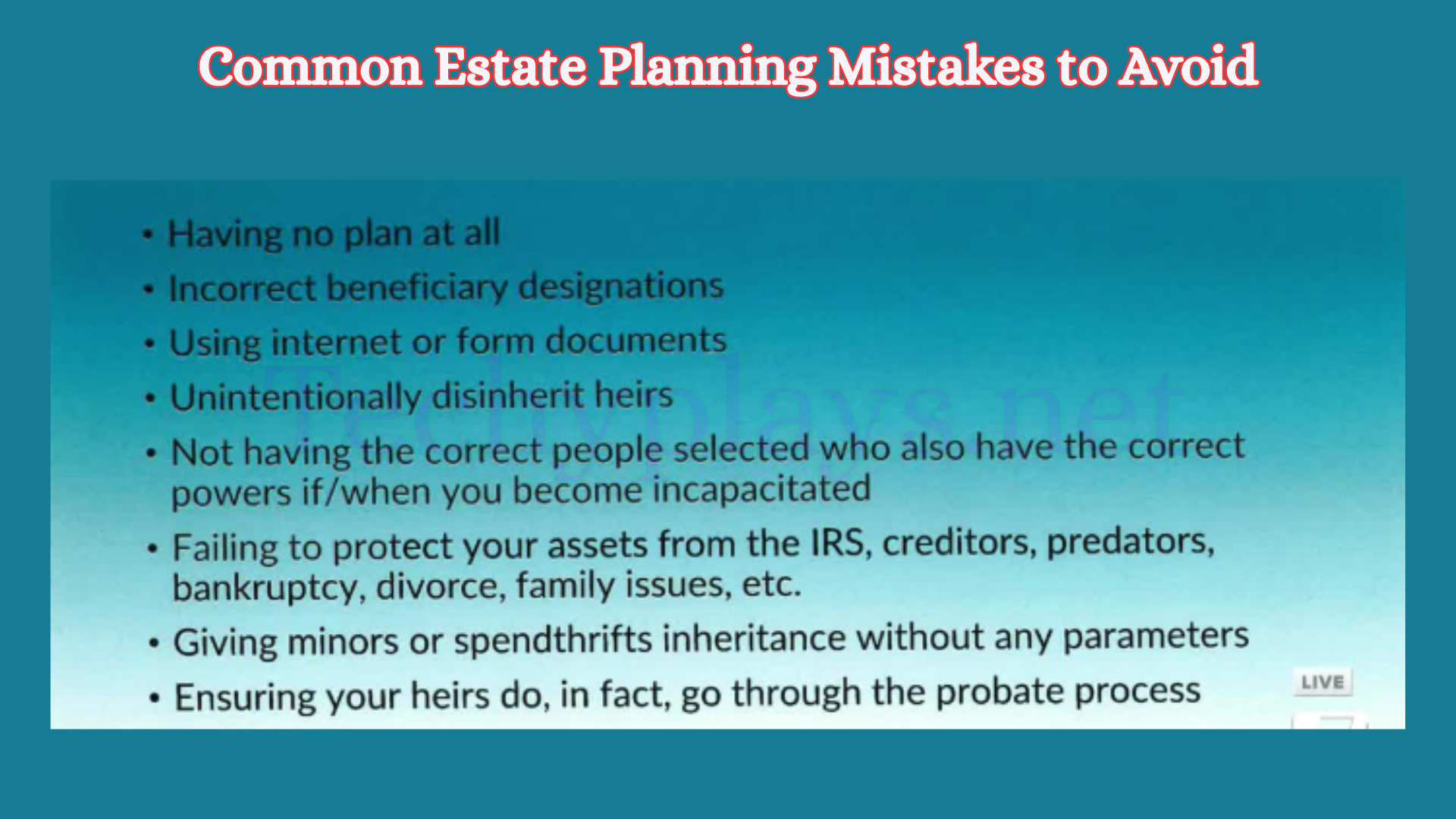

Section 4: Common Estate Planning Mistakes to Avoid

Mistake #1: Not Updating Your Plan

Life changes (marriages, divorces, births, deaths) require updates. Review your estate plan every 3-5 years or after major life events.

Mistake #2: DIY Wills & Online Forms

Generic templates may not comply with state laws, leading to invalid documents. Always consult a lawyer.

Mistake #3: Forgetting Digital Assets

Include instructions for:

- Social media accounts

- Cryptocurrency wallets

- Online banking & subscriptions

Mistake #4: Choosing the Wrong Executor or Trustee

Select someone who is:

- Trustworthy

- Organized

- Capable of handling legal/financial tasks

Section 5: Advanced Estate Planning Strategies

1. For High-Net-Worth Individuals

- Irrevocable Life Insurance Trusts (ILITs) – Reduce estate taxes.

- Charitable Remainder Trusts (CRTs) – Donate to charity while receiving income.

- Family Limited Partnerships (FLPs) – Protect business assets.

2. For Blended Families

- Qualified Terminable Interest Property (QTIP) Trusts – Ensure fair inheritance for spouses and children from previous marriages.

3. For Business Owners

- Buy-Sell Agreements – Plan for business succession.

- Succession Trusts – Smooth transition of ownership.

FAQ’s About Best Lawyers Near Me for Wills and Estate Planning

What’s the difference between a will and a trust?

A will only takes effect after death and must go through probate court, while a trust can avoid probate, provide privacy, and manage assets during incapacity. Trusts are more flexible but cost more upfront.

Do I need a lawyer to create a will?

While DIY wills are available, a lawyer ensures your documents comply with state laws, minimizes legal risks, and provides personalized advice—especially for complex estates.

How much does an estate planning lawyer cost?

Costs vary:

Simple will: 300–300–1,200

Living trust: 1,500–1,500–3,500+

Hourly rates: 150–150–500/hour

Many attorneys offer flat-fee packages for basic estate plans.

What happens if I die without a will?

Your estate is distributed according to state intestacy laws, which may not align with your wishes. The court appoints an executor, and the process can be slow and expensive.

Can I update my will later?

Yes! You can amend your will with a codicil or create a new one. Major life changes (marriage, divorce, new children) should prompt a review.

How do I choose an executor or trustee?

Pick someone:

Trustworthy and financially responsible

Willing to take on the role

Ideally, younger than you (to outlive you)

You can also name a professional (e.g., a bank or attorney) for complex estates.

Conclusion

Estate planning isn’t just about distributing assets—it’s about protecting your loved ones from legal battles, financial stress, and unnecessary taxes. By working with an experienced wills and estate planning lawyer, you can:

✅ Ensure your wishes are followed – Prevent courts from deciding who inherits your property.

✅ Save time and money – Avoid probate delays and reduce legal fees.

✅ Protect minor children – Designate guardians and manage inheritances responsibly.

✅ Plan for incapacity – Appoint trusted agents to handle finances and healthcare.