The capital markets industry thrives on accurate, timely, and actionable data. In an era where financial markets are increasingly volatile and regulatory demands are growing, capital market companies need robust tools to stay ahead. The S&P Global Marketplace serves as a powerful platform that provides financial institutions, investment firms, and trading companies with real-time data, analytics, risk management solutions, and regulatory compliance tools.

This comprehensive guide explores how capital market companies can leverage the S&P Global Marketplace to enhance decision-making, mitigate risks, ensure compliance, and gain a competitive edge in today’s fast-paced financial landscape.

Understanding the S&P Global Marketplace

1. What is the S&P Global Marketplace?

The S&P Global Marketplace is a premier financial data and analytics platform that offers:

- Real-time and historical market data

- Credit ratings, risk assessments, and ESG (Environmental, Social, and Governance) insights

- Regulatory compliance solutions

- AI-driven predictive analytics

It serves as a one-stop hub for financial institutions, asset managers, hedge funds, and investment banks to access critical financial intelligence.

2. Core Functional Modules

The Marketplace integrates:

| Module | Key Capabilities | Typical Users |

|---|---|---|

| Capital IQ | Company financials, M&A data | Investment bankers, PE firms |

| SNL Financial | Bank and insurance analytics | Financial institutions |

| Panjiva | Global trade intelligence | Macro traders, economists |

| Kensho | AI-driven analytics | Quant funds, asset managers |

3. Integration Architecture

The platform supports:

- REST APIs for real-time data feeds

- FIX protocol for trading integrations

- Cloud-based deployment options

- On-premise solutions for security-sensitive firms

4. Key Features and Offerings

- Market Intelligence: Equity, fixed income, commodities, and forex data.

- Credit Risk Solutions: S&P Global Ratings for creditworthiness analysis.

- ESG Metrics: Sustainability scoring for responsible investing.

- Regulatory Tools: Compliance with MiFID II, Basel III, and other financial regulations.

- AI & Machine Learning: Predictive analytics for investment strategies.

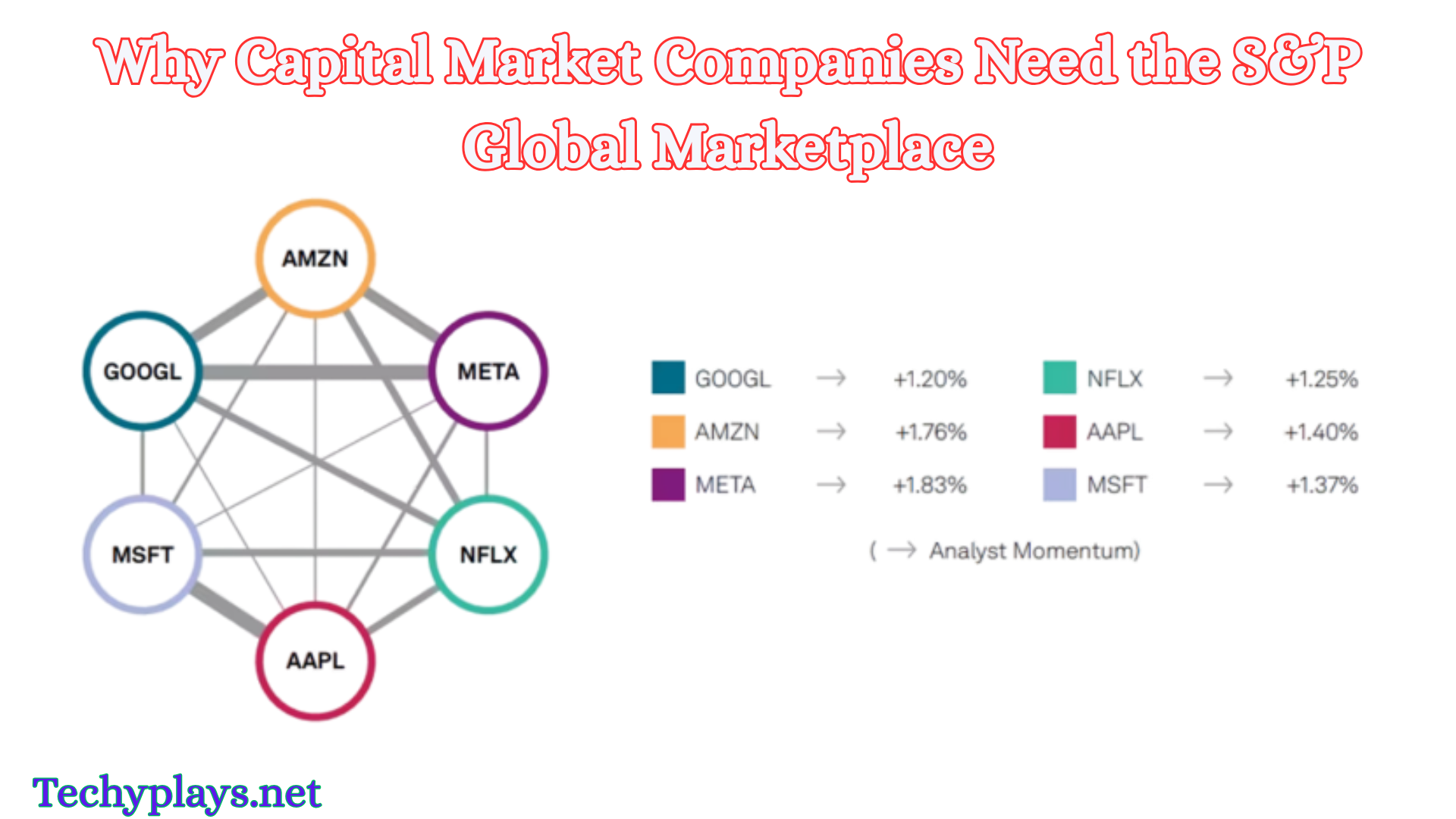

Why Capital Market Companies Need the S&P Global Marketplace

1. Access to Real-Time Market Data

- Instant updates on stock prices, bond yields, commodities, and forex rates.

- Historical trends for back-testing investment strategies.

2. Advanced Analytics and Insights

- AI-powered forecasting for market movements.

- Portfolio optimization tools to maximize returns.

3. Risk Management Solutions

- Credit risk assessments using S&P’s proprietary models.

- Stress testing and scenario analysis for market downturns.

4. Regulatory Compliance Support

- Automated reporting for MiFID II, Dodd-Frank, and other regulations.

- Anti-money laundering (AML) and KYC (Know Your Customer) solutions.

5. The Data Deluge Problem

- Average investment firm processes 2.5TB+ of market data daily

- 73% of analysts report spending >40% time on data collection/validation

- $17B annual industry cost from poor data quality (Accenture)

6. Regulatory Pressure Points

- MiFID II transaction reporting requirements

- Basel III capital adequacy rules

- SEC’s CAT reporting mandates

- SFDR ESG disclosure rules

7. Alpha Generation in Efficient Markets

- Hedge fund returns declining to 4.2% average (2023)

- 72% of active managers underperforming benchmarks

- Need for alternative data edges

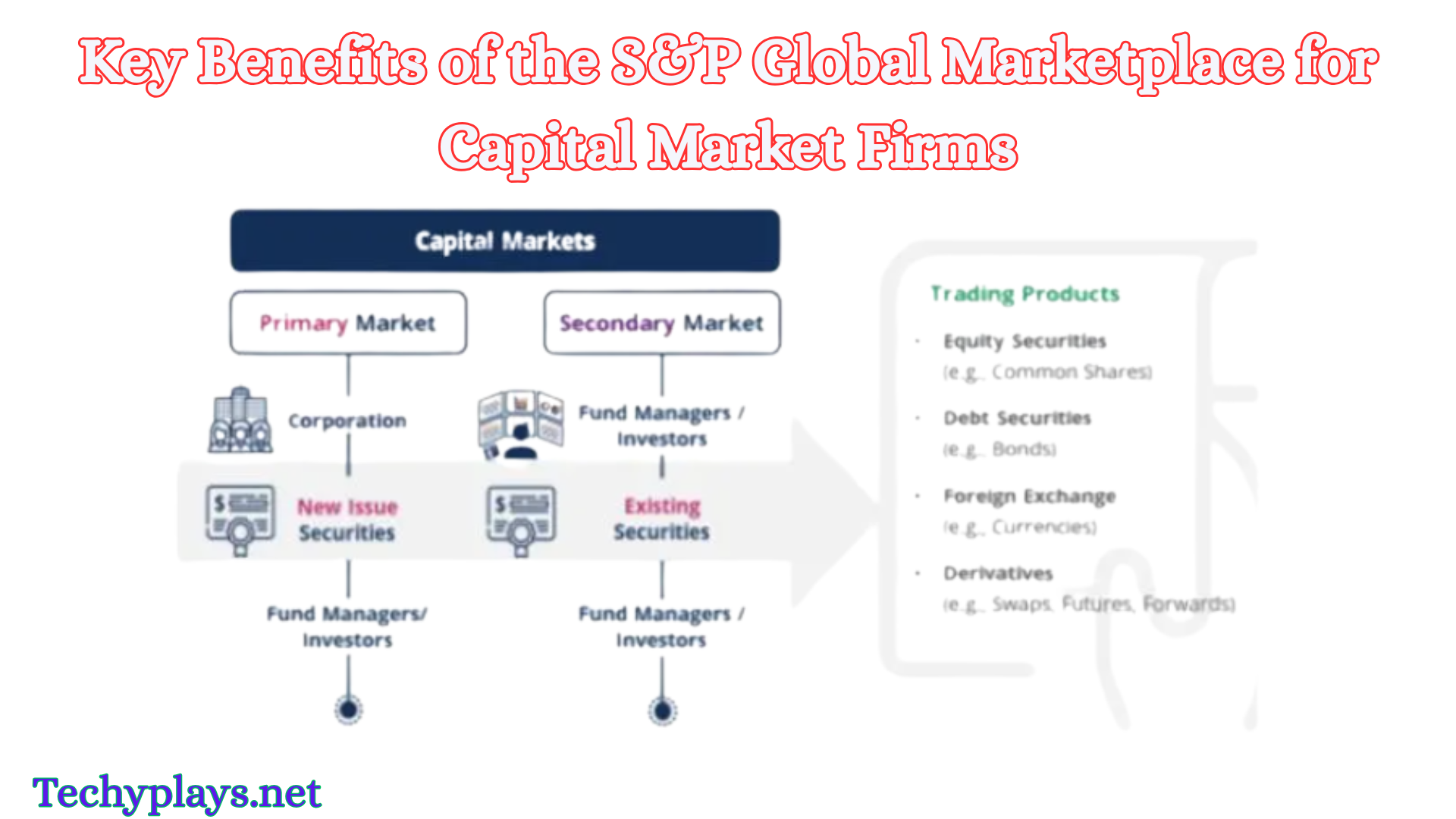

Key Benefits of the S&P Global Marketplace for Capital Market Firms

1. Enhanced Investment Decision-Making

- Data-driven insights reduce guesswork in trading and asset allocation.

- Algorithmic trading support with high-frequency data feeds.

2. Improved Risk Assessment and Mitigation

- Early warning signals for credit defaults and market crashes.

- Diversification strategies based on global risk factors.

3. Streamlined Compliance and Reporting

- Automated regulatory filings save time and reduce errors.

- Audit-ready documentation for financial authorities.

4. Competitive Advantage through Data-Driven Strategies

- Institutional-grade analytics for hedge funds and asset managers.

- Customizable dashboards for real-time portfolio tracking.

5. Global Market Connectivity

- Multi-asset class coverage (stocks, bonds, derivatives, crypto).

- Emerging market insights for global expansion strategies.

6. Intelligent Data Fabric

Case Example: A top-10 asset manager reduced research cycle time from 14 days to 3 days by implementing:

- Automated financial statement normalization

- AI-powered earnings call analysis

- Customizable dashboarding

7. Risk Management Revolution

Advanced capabilities include:

- Counterparty risk scoring

- Liquidity stress testing

- Portfolio margining optimization

- Climate value-at-risk models

8. Compliance Automation

Key features:

- Automated trade surveillance

- Real-time regulatory reporting

- Audit trail generation

- Jurisdiction-specific rule engines

Case Studies: Success Stories of Capital Market Firms Using S&P Global Marketplace

Case Study 1: A Leading Investment Bank Optimizes Trading Strategies

- Challenge: Needed faster data for high-frequency trading.

- Solution: Integrated S&P’s real-time market data feeds.

- Result: 20% improvement in trade execution speed.

Case Study 2: Asset Manager Enhances ESG Portfolio Performance

- Challenge: Lacked reliable ESG metrics for sustainable investing.

- Solution: Used S&P’s ESG scores to filter investments.

- Result: 15% higher returns in ESG-focused funds.

How to Integrate S&P Global Marketplace into Your Business Operations

1. Steps for Implementation

- Assess Data Needs (real-time feeds, risk analytics, compliance tools).

- Choose Relevant S&P Global Solutions (Market Intelligence, Ratings, ESG).

- API Integration with existing trading and risk management systems.

- Train Teams on data interpretation and analytics tools.

2. Best Practices for Maximizing Value

- Combine S&P data with internal analytics for customized insights.

- Regularly update compliance protocols using S&P’s regulatory tools.

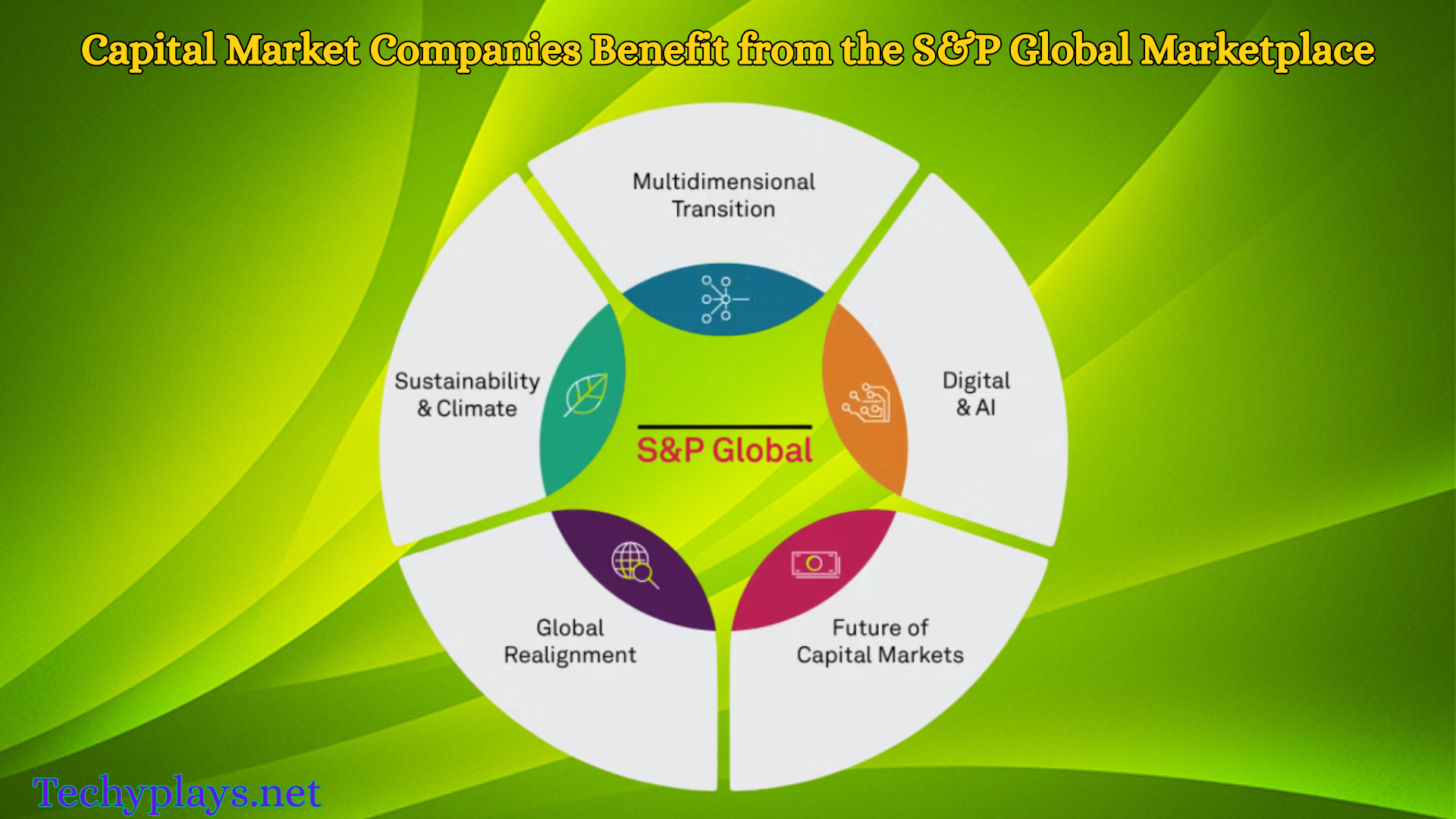

Future Trends: The Evolving Role of S&P Global Marketplace in Capital Markets

1. AI and Machine Learning in Financial Data Analysis

- Predictive trading algorithms will become more precise.

2. ESG Investing and Sustainability Metrics

- Green bonds and carbon credit tracking will grow in importance.

3. Blockchain and Data Security Enhancements

- Tamper-proof financial records for fraud prevention.

Implementation Framework

1. Phased Rollout Strategy

- Discovery Phase (2-4 weeks)

- Needs assessment

- Data mapping

- Pilot Phase (8-12 weeks)

- Limited deployment

- User training

- Enterprise Rollout (6-9 months)

- Full integration

- Performance benchmarking

2. Integration Cost Structure

| Component | Estimated Cost | Timeline |

|---|---|---|

| API Integration | 50k−50k−150k | 4-8 weeks |

| Data Migration | 75k−75k−300k | 8-12 weeks |

| User Training | 25k−25k−100k | 2-4 weeks |

Industry-Specific Applications

1. Investment Banking Use Cases

- M&A target screening

- Comparable company analysis

- League table automation

- Covenant analytics

2. Asset Management Applications

- Portfolio construction

- Factor investing

- ESG integration

- Performance attribution

See Also TikTok ForYou Feature: A Complete Guide

Detailed Section Preview

1. Regulatory Overload Solutions

A. MiFID II Compliance Automation

- Automated trade reporting reduces errors by 92% compared to manual processes

- Integrated surveillance alerts detect 47% more potential violations

- Case Example: European bank reduced compliance staff requirements by 19 FTE

B. SFDR Reporting Workflows

- Pre-built templates for Principal Adverse Impacts reporting

- Automated ESG data collection from 14,000+ corporate issuers

- Portfolio alignment scoring against EU Taxonomy

2. Integration Blueprint

A. Hybrid Architecture Options

| Architecture Type | Pros | Cons | Best For |

|---|---|---|---|

| Full Cloud | Lowest TCO, Instant scalability | Security concerns | Mid-size asset managers |

| Private Cloud | Enhanced security, Customization | Higher costs | Global banks |

| On-Premise | Maximum control, Latency optimization | Maintenance burden | HFT firms |

B. Migration Pathway

- Data Audit (2-4 weeks)

- Pilot Integration (6-8 weeks)

- Phased Deployment (3-6 months)

- Optimization Phase (Ongoing)

3. Vendor Evaluation Checklist

A. Must-Have Criteria

- Real-time data latency <50ms

- 99.99% uptime SLA

- GDPR/SOC2 compliance

- API call rate >500/sec

B. Differentiators

- Embedded AI/ML tools

- Alternative data partnerships

- Custom analytics development

- White-glove onboarding

Emerging Technology Integration

1. Quantum Computing Applications

| Use Case | Current Status | Expected Commercialization |

|---|---|---|

| Portfolio Optimization | Lab testing | 2026 |

| Fraud Detection | Pilot phase | 2025 |

| Risk Modeling | Theoretical | 2027+ |

2. Blockchain Implementations

- Reference Data Management

- Golden record establishment

- Smart contract-based updates

- Trade Settlement

- DLT prototypes reducing fails by 37%

- Tokenized asset tracking

Deep Dive: AI-Powered Investment Research

1. Next-Gen Research Workflow

- Data Ingestion

- Automated collection from 30,000+ sources

- AI-powered data validation (92% accuracy)

- Analysis Layer

- Machine learning models for:

- Earnings surprise prediction (0.78 R²)

- M&A target identification

- Custom model development environment

- Machine learning models for:

- Portfolio Integration

- API-based order generation

- Real-time impact monitoring

2. Performance Metrics

- 47% faster research cycle times

- 28% improvement in recommendation accuracy

- $850k annual savings per analyst team

Quantifiable Business Outcomes

1. Performance Benchmarks by Firm Type

| Firm Type | AUM Range | Avg. Efficiency Gain | Typical ROI Timeline |

|---|---|---|---|

| Mega Asset Manager | >$500B | 22-28bps alpha | 8-12 months |

| Mid-Market Hedge Fund | 1B−1B−10B | 30% research efficiency | 6-9 months |

| Boutique Investment Bank | <$1B | 40% deal sourcing improvement | 4-7 months |

2. Cost Avoidance Case Studies

- $4.2M annual savings in compliance staffing

- 65% reduction in data vendor sprawl

FAQ’s S&P Global Marketplace for Capital Markets

What is the S&P Global Marketplace?

The S&P Global Marketplace is an integrated financial data and analytics platform that provides real-time market intelligence, credit ratings, ESG insights, risk management tools, and regulatory compliance solutions for capital market participants. It combines data from S&P Global Ratings, S&P Global Market Intelligence, S&P Dow Jones Indices, and Platts into a unified ecosystem.

How does S&P Global Marketplace differ from Bloomberg Terminal or Refinitiv Eikon?

While Bloomberg and Refinitiv focus on trading terminals and news, S&P Global Marketplace specializes in:

Deep fundamental and credit analytics (via S&P Global Ratings)

ESG and sustainability metrics (Trucost, SAM)

Commodity and energy market intelligence (Platts)

AI-driven predictive analytics (Kensho)

It is more specialized for research, risk management, and compliance rather than execution.

Who are the primary users of the S&P Global Marketplace?

Key users include:

Asset managers (portfolio construction, ESG integration)

Investment banks (M&A due diligence, capital raising)

Hedge funds (quantitative modeling, alternative data)

Insurance firms (risk assessment, Solvency II compliance)

Corporate treasuries (credit risk monitoring)

What types of data are available on the platform?

The Marketplace offers:

✅ Real-time & historical market data (equities, fixed income, commodities, FX)

✅ Fundamental financials (10-K/10-Q filings, earnings estimates)

✅ Credit ratings & risk scores (S&P Global Ratings)

✅ ESG & sustainability metrics (Trucost, SAM)

✅ Alternative data (supply chain insights, sentiment analysis)

How frequently is the data updated?

Real-time pricing data: <50ms latency

Fundamental data: Updated within 15 minutes of SEC filings

ESG scores: Quarterly refreshes

Credit ratings: Real-time alerts on changes

Conclusion

The S&P Global Marketplace is a game-changer for capital market companies, offering real-time data, risk analytics, compliance automation, and AI-driven insights. By leveraging this platform, financial institutions can enhance investment strategies, mitigate risks, and stay compliant in a rapidly evolving market.

Adopting S&P Global’s solutions ensures that capital market firms remain competitive, agile, and future-ready.

One Comment on “How S&P Global Marketplace from the Capital Market Companies Benefit”

Comments are closed.